Invoices are an integral part of any business that directly affects its cash flow and financial health. It’s critical to manage them properly and reflect them in accounting correctly. Failing to do it can result in accounting jeopardy and, consequently, inaccurate financial statements, headaches reconciling your books with the bank, and making wrong business decisions based on incorrect data.

Often, you might get into a situation when you’ve paid invoices in the payment processing system that are still open in accounting. Closing them manually can be challenging, especially if you have to look through hundreds of invoices in Stripe to verify the received payments and then find the corresponding invoices in QuickBooks to edit. At this point, you might want to automate the process.

In this article, we’ll look at how to integrate Stripe and QuickBooks, synchronize Stripe invoices with QuickBooks, and close them automatically upon payment.

Contents:

1. Why do you need to sync invoices between payment processors and accounting?

2. Why might you want to integrate Stripe and Quickbooks?

3. How to integrate Stripe and QuickBooks

4. How to sync open invoices into QuickBooks and close them automatically?

Why do you need to sync invoices between payment processors and accounting?

Outstanding invoices can be a bottleneck for the cash flow, preventing a company from paying their bills on time, investing in new equipment or inventory, and getting more revenue. According to a recent USMCA report, the increasing tendency of late invoice payments has been observed lately, with nearly 47% of B2B sales affected. As you can see, lots of businesses have to struggle to get their invoices paid on time. Naturally, invoice management is the part of the business workflow that needs special attention and effort to ensure stable cash flow with the fewest obstacles possible.

Apart from late payments, missing unpaid invoices or incorrectly allocating payments to open invoices in accounting can cause serious cash flow issues. Moreover, the latter might be one of the reasons for accounting jeopardy, as it causes discrepancies between the books and the business bank account. It directly affects reconciliation, making those responsible for the finances devote extra effort to compare the received payments in the payment system with the accounting to identify errors and correct them. It can be dramatically time-consuming and affect the overall efficiency of bookkeeping and accounting.

Integrating payment systems with accounting can become a solution to the issue. It can help synchronize financial records between the systems and thus avoid errors in allocating payments to open invoices, ensuring more efficient invoice management.

Let’s look at how this integration can work on the example of Stripe and QuickBooks.

Why might you want to integrate Stripe and QuickBooks?

As an e-commerce or online business, you might already be familiar with Stripe and QuickBooks or even using this tandem to run the financial part of the business. You might have also been looking at these solutions choosing the best options for online payments processing and convenient accounting, starting your company. No wonder. Both provide a high-class experience and help drastically facilitate the management of an online business. The platforms easily integrate, allowing for the synchronization of transaction data, including invoices.

Why might you want to use QuickBooks?

QuickBooks is an accounting system by Intuit, created for small- and medium-sized businesses, both off- and online. It’s one of the most popular accounting solutions in the US market. Easy to install and use, it helps to get away from paper or spreadsheet bookkeeping, providing accounting and other business management options that include payroll, inventory management, invoicing, creation of financial statements, etc. Thanks to its shared access, it can easily fit the bill for businesses that outsource their accounting and bookkeeping and those having in-house accounting. QuickBooks comes in two versions: the cloud-based QuickBooks Online and the QuickBooks Desktop option for those who prefer to keep their accounting data locally.

One of the biggest advantages of QuickBooks is the ability to integrate with many third-party solutions, which levels up user experience with the system. Altogether, it makes QuickBooks a good choice for service-based and e-commerce businesses helping them to stay on top of their finances.

Why might you want to use Stripe?

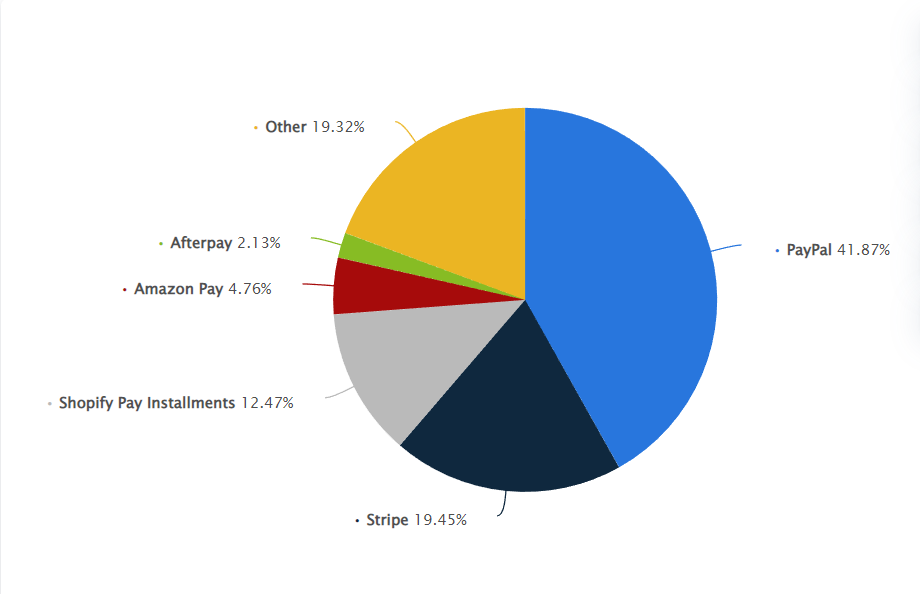

Stripe is one of the leading payment processors in the US and worldwide (by the number of users, it’s only second to PayPal). It allows you to quickly and securely accept payments, including online, recurring, and even in-person (using its point-of-sale option, Stripe Terminal), supporting a wide range of payment methods and currencies.

Many businesses, from start-ups to well-established and renowned ones such as TED, Zoom, Wired, Slack, and more, rely on Stripe as their payment gateway. Stripe is also among the most trusted payment gateways on popular e-commerce platforms – Amazon and Shopify. The biggest Stripe benefits for businesses and their customers comprise an excellent set of security measures, including SSL protection and encryption of the payment information. It also enables businesses to provide a seamless checkout experience and accept payments without delay, offers a transparent processing fee structure, and more.

The benefits of Stripe and QuickBooks integration

With the above said in mind, having Stripe for payments and QuickBooks for accounting can make a solid backbone for an online business. So if you’re just staring your e-commerce business and are looking for solutions to cover the financial part of it, you might want to consider this tandem as a reliable and secure option. Should you already be using these solutions to run your business, you might want to take one more step to link the platforms into a single ecosystem and automate some bookkeeping and accounting workflows (those include automatically closing Stripe invoices open in QuickBooks upon payment; we’ll get to it just a little later).

The integration of Stripe with QuickBooks means that the financial data from the payment processor can be automatically transmitted to the accounting system, thus eliminating time-consuming manual data entry. While saving time is undoubtedly a great benefit, it’s not the most significant thing about Stripe and QuickBooks integration. Many solutions on the market allow for synchronizing Stripe data with QuickBooks. We’ll look at some other benefits of QuickBooks Stripe integration using Synder as an example.

- Work in the background. As soon as you integrate the platforms, data import can run on total autopilot. You won’t need to worry about logging in to start synchronization – as soon as you have a sale or an invoice payment in Stripe, it’ll be imported into your QuickBooks automatically. However, you can choose the level of automation you’re comfortable with. Should you like to check the data before letting it in the books, you can go with a semi-automated mode, switching the auto-sync off. This way, you’ll be able to review the transactions ready for synchronization and start the process manually.

- Data categorization. Integrating Stripe and QuickBooks can allow you to take the burden of having to properly categorize transactions in accounting off your shoulders. Transaction details, such as sales, payment processing fees, taxes, and so on, will be correctly placed in the corresponding accounts in QuickBooks, ensuring informative financial statements and reports and accurate tax filing. Moreover, by recognizing product and customer data, payments are automatically associated with customers and products you track in accounting (if you need to).

- Workflow automation. Apart from financial data synchronization, some other business workflows can be automated, bringing more value to a business owner or those others responsible for the financial side of a business. Applying Stripe payments to open invoices in QuickBooks automatically is just one of them. You might want to go further and set up to be notified about unpaid invoices or even send automatic reminders to people if their payments are overdue.

How to integrate Stripe and QuickBooks

Now, let’s get to the practical part and see how you can integrate Stripe with QuickBooks using Synder. It allows connecting both online and desktop versions of the software. Since the workflow will slightly differ, we’ll tackle both variants.

How to integrate Stripe with QuickBooks Online

Simply put, the integration process is pretty straightforward: you need to connect both your Stripe and QuickBooks accounts to Synder, making it the bridge that joins them in a single ecosystem.

But let’s go through it step by step.

If you’ve never used Synder before, you might want to sign up. There’s a free trial account available, so you can test your integration and whether it works for you before making any commitment. You can sign up by either choosing your Google or Intuit credentials or creating your Synder account. You will be offered to select the Synder product you want to go with – in this case, Synder Sync.

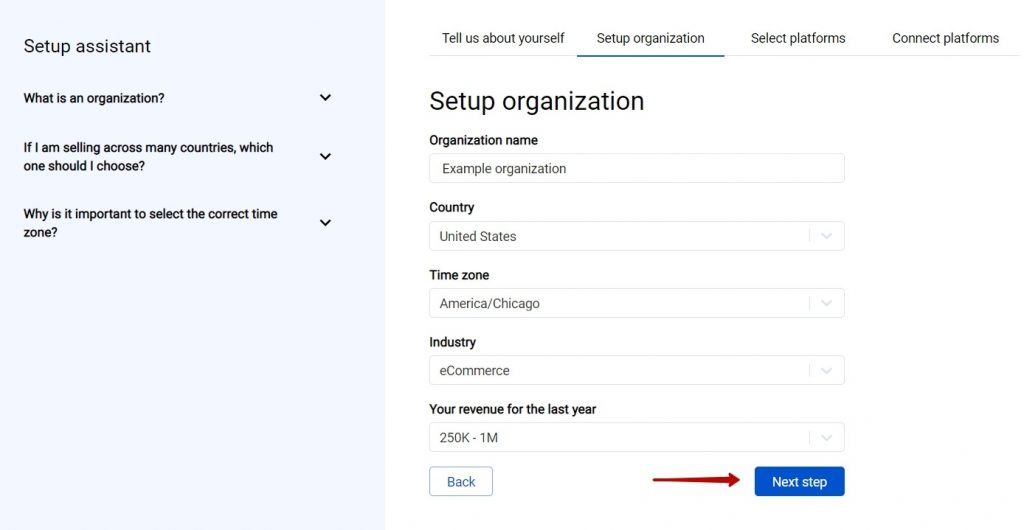

1. Upon filling in your account basic information, you’ll need to create your Organization (which is, actually, your business’s/client’s space in Synder) to which you’ll be connecting your accounting and payment systems.

Just fill in the necessary fields, and click the Next step button to proceed.

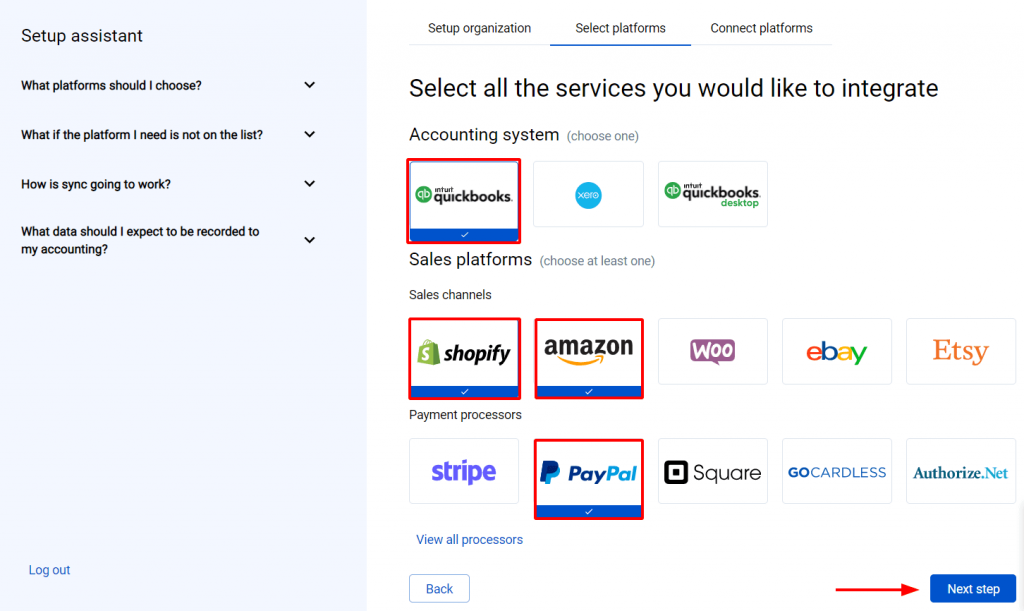

2. Connect your QuickBooks Online and Stripe to Synder. Select the corresponding options from the list that appears on the page clicking on each of the platform’s logos. Please bear in mind that you can connect only one accounting platform within one organization. However, you can select as many payment and e-commerce platforms as you need to bring your records from to your accounting. You can also start with just one of them, for instance, Stripe, and add the rest later.

Click the Next step button to continue setting up the integration.

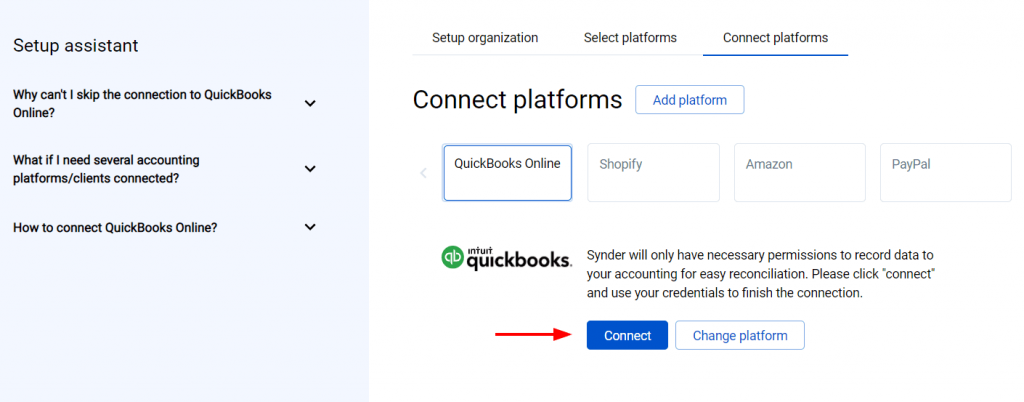

3. Grant permissions to Synder to fetch and record the data within your integration. Do it by clicking the Connect button on the page that appears (At this step, you might need to ask the account owner, if you’re doing it for your client, for example, to fill in the necessary fields).

Repeat the same for your e-commerce and payment platforms.

How to integrate Stripe with QuickBooks Desktop

For QuickBooks Desktop, the setup will be a little bit different. Let’s go through it.

1. You start with signing up to Synder and creating your Organization.

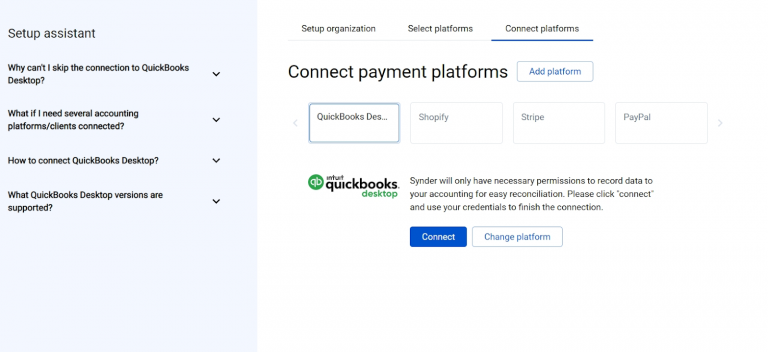

2. Then it’s time to select your platforms – QuickBooks Desktop for accounting and Stripe for payment processing.

3. Connect QuickBooks Desktop. Click the Connect button and follow the instructions.

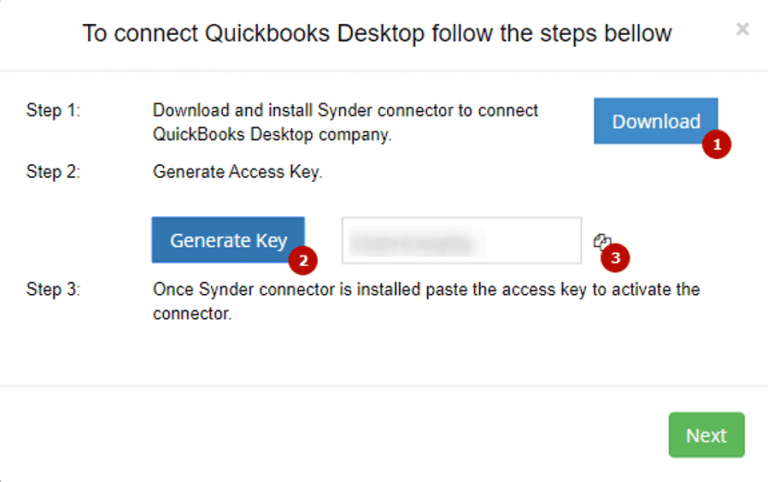

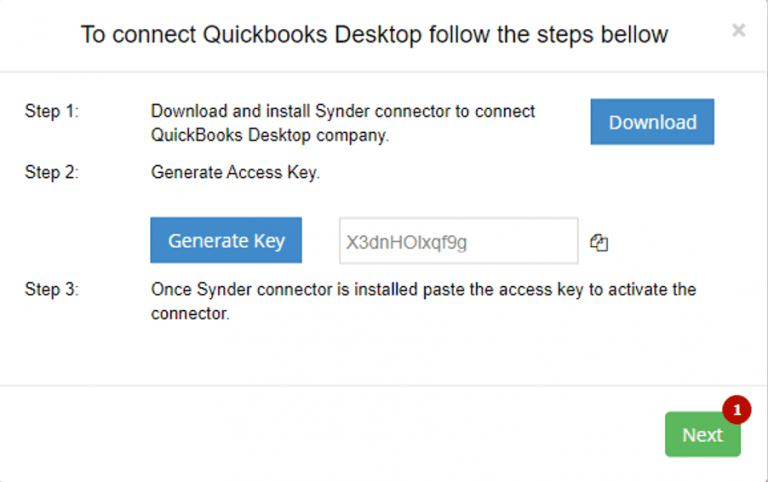

4. Download the connector app(1), click Generate Key (2), and Copy it to buffer (3)

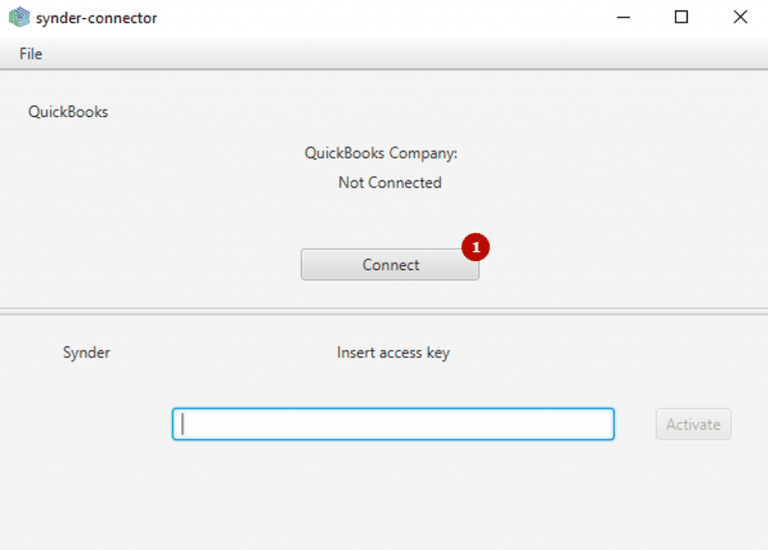

5. Open the downloaded file synder-setup.exe and click the Connect button to connect your QuickBooks Desktop.

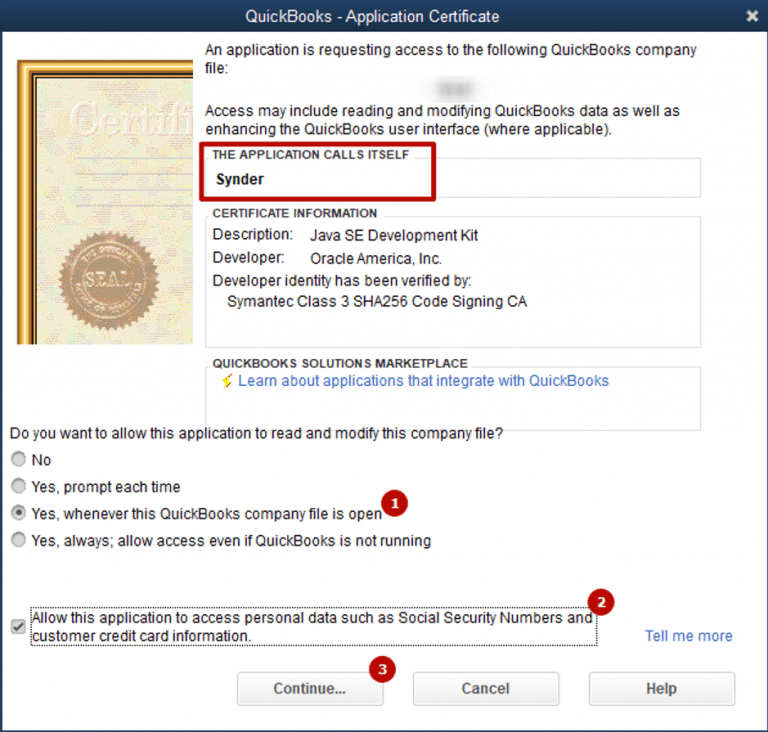

6. Tick corresponding options (1,2) to set up QuickBooks Certificate and click Continue (3).

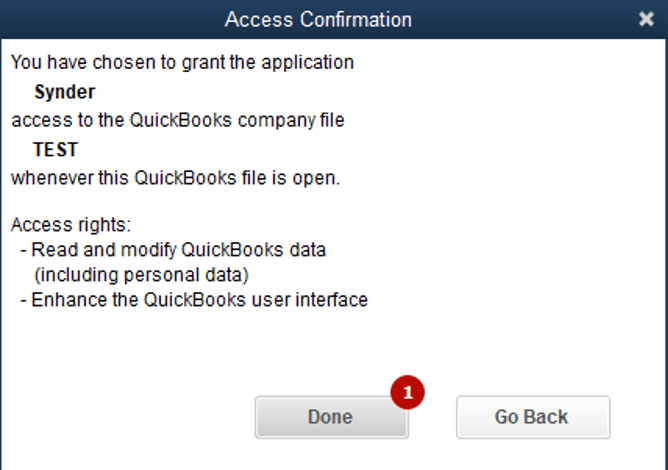

7. Check the information in the window that appears and confirm it by clicking Done.

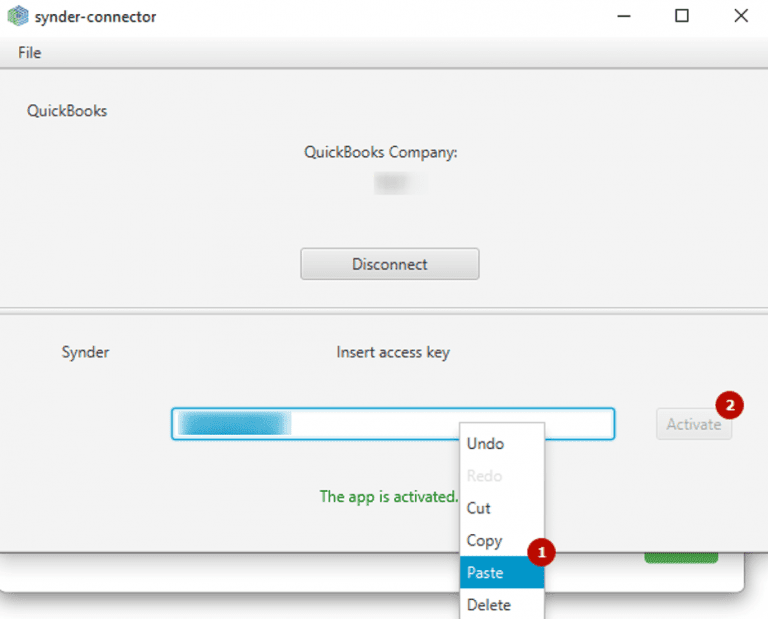

8. Paste the previously copied key into the Insert access key field on the next step.

9. Go back to the Synder website and click Next to proceed to the setup of payment platforms.

Now, you can continue setting up your QuickBooks and Stripe integration, including closing Stripe invoices automatically.

How to sync open invoices into QuickBooks and close them automatically?

When you connect QuickBooks and Stripe to Synder, all your transactions from the payment system will be automatically synchronized with your accounting. In general, no more action is needed from your side.

However, you can always customize your integration to suit your business’s needs. This includes applying payments to open invoices in QuickBooks automatically. Here’s how you can set it up:

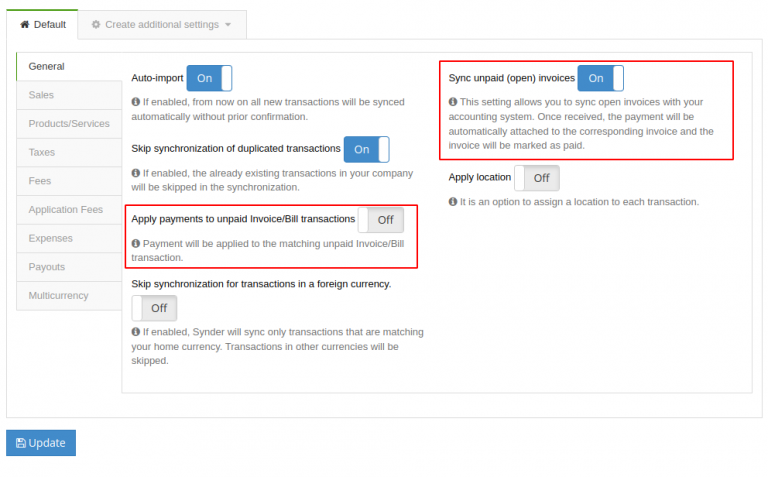

In your Synder dashboard, click the gear sign and go to the General settings tab. Switch ON the Apply payments to unpaid invoice/Bill transactions and Sync unpaid (open) invoices.

From now on, Synder will be importing your open invoices from Stripe to QuickBooks and automatically mark them as paid as soon as the payment occurs. Please note that the setting is going to work, provided that the customer names and/or emails match.

You can go with some different ways of setting up this feature, depending on your peculiar needs.

Find out How much does QuickBooks charge for Credit Card payments.

Bottom line

Being an e-commerce business or a different kind of online business with high volumes of transactions, automating some of the business processes can be beneficial and save countless hours of manual work.

Synder can easily integrate Stripe with QuickBooks, as well as offer 25+ other integrations, so you can configure your business automation for almost all the sales channels you can think about.

You can give Synder a free try or book a demo to learn more details about how it can help your business.