When you’re running a subscription-based business, it’s vital to keep a close eye on your revenue. You want to make sure you’re accurately recognizing it, so you have a clear financial picture and can make informed decisions. But let’s face it, manually tracking and reconciling revenue can be a real pain. It takes up a ton of time and can lead to mistakes that mess up your finances. Luckily, with Synder’s powerful revenue recognition feature, you can make the whole process a breeze. It helps you streamline everything, so you can recognize revenue with precision and save yourself valuable time and resources.

Synder’s role in revenue recognition

Synder serves as an indispensable bridge between two leading industry platforms: Stripe and QuickBooks. Going beyond seamless data synchronization and reconciliation, Synder empowers subscription-based businesses with its comprehensive revenue recognition capabilities. What sets Synder apart is its unique ability to autonomously manage revenue recognition, eliminating the need for external systems (or Stripe) to recognize revenue independently.

How to set up revenue recognition with Synder

Setting up revenue recognition with Synder is incredibly straightforward. Simply begin by connecting your Stripe and QuickBooks accounts. Next, choose the desired start date for revenue recognition and effortlessly import data from that specific point onward into Synder. Once the import process is finalized, Synder takes the reins and automatically generates meticulous revenue recognition schedules for each imported subscription. These schedules are expertly crafted using a wealth of data extracted from Stripe, including billing start and end dates, invoices, refunds, product lines (both one-time and recurring products), amounts, discounts, as well as subscription updates and cancellations. Synder ensures that no detail is overlooked in creating accurate and comprehensive revenue recognition records.

How does revenue recognition with Synder work?

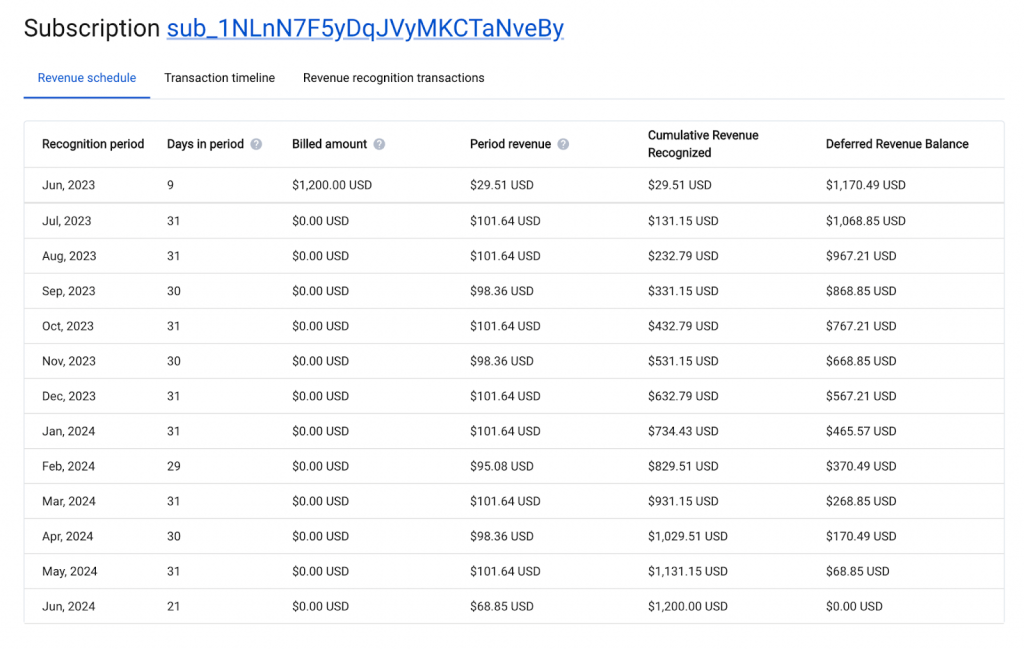

The generated schedule provides a month-by-month breakdown of the recognized revenue for each subscription, be it monthly or yearly. Leveraging all available information, Synder’s schedules offer a comprehensive view of revenue recognition. By offering this level of detail, the tool greatly facilitates accurate financial reporting and analysis, empowering businesses to make informed decisions based on reliable revenue data.

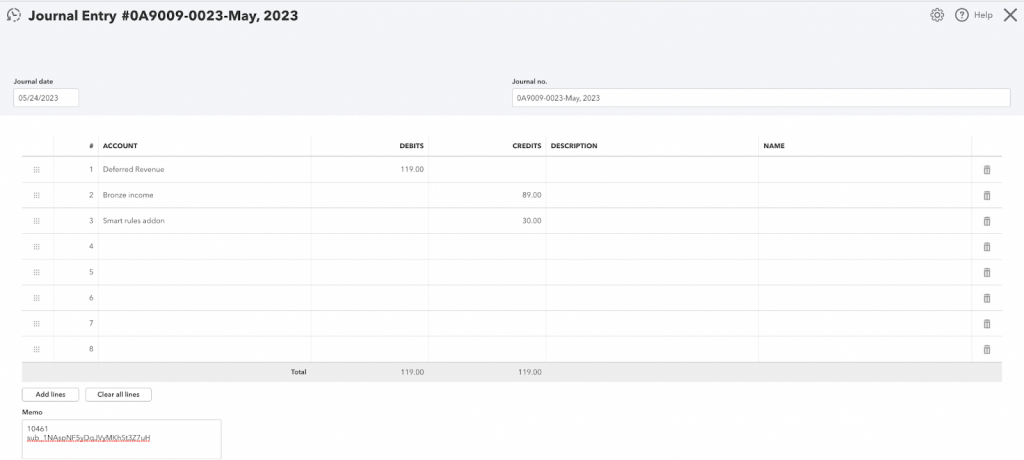

To implement this efficient system, you will need to complete the setup process in both Synder and QuickBooks. Please note that in QuickBooks, any product or service associated with subscriptions should be linked to a Deferred Revenue account rather than a regular income account. This ensures that when Synder records an invoice, the deferred revenue account is increased accordingly.

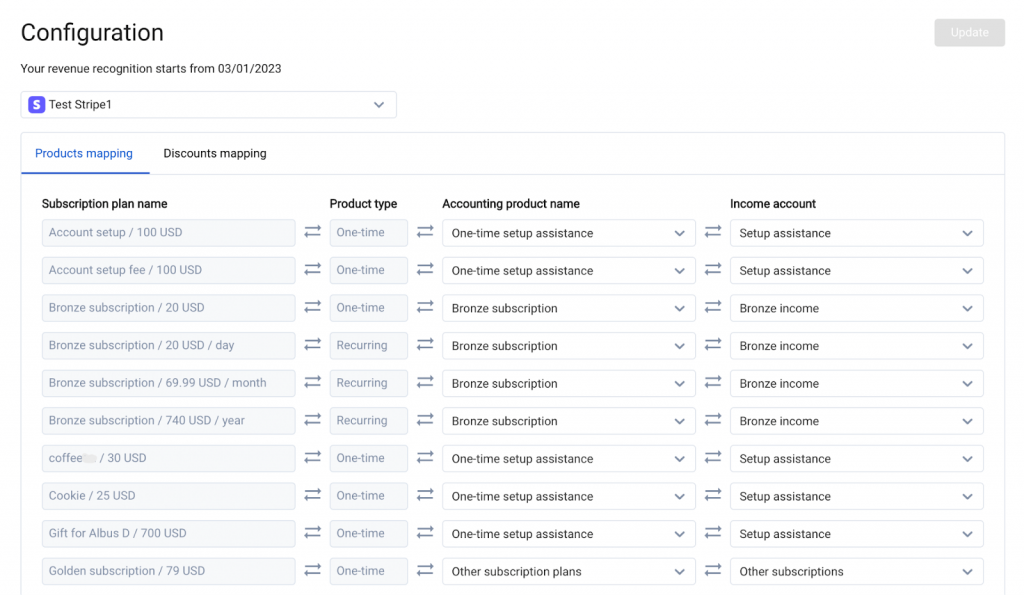

In Synder, each imported subscription price from Stripe should be mapped to the appropriate QuickBooks product and income account. This mapping allows Synder to accurately determine the income accounts for revenue recognition. Once the setup is complete, Synder seamlessly syncs the generated journal entries to your books. These entries are recorded as of the last day of each month and the corresponding revenue amount for each product is transferred from the Deferred Revenue account to the designated Income account.

There’s more to Synder’s intelligence! It doesn’t stop at importing historical data. Synder goes the extra mile by actively monitoring subscription updates in Stripe. This means that it automatically recalculates recognition schedules for the current month and future months, taking into account any changes like downgrades, upgrades, or modifications to subscriptions. This intelligent capability ensures that your revenue recognition schedules stay up to date and accurately reflect any adjustments made to your subscriptions. With Synder, you can rest assured that your revenue recognition is always on point, even as your subscriptions evolve.

Furthermore, Synder effortlessly manages subscription refunds and cancellations. In the event of a cancellation, Synder recognizes the unused portion of the subscription within the respective period. On the other hand, when refunds occur, Synder deducts the refunded amount from the deferred revenue account associated with the refunded product, effectively decreasing the income account. By adeptly handling refunds, Synder guarantees precise revenue recognition, even in complex scenarios.

Synder’s revenue recognition feature also optimizes the recognition process for one-time products. In such instances, revenue is promptly recognized in the period when the invoice is issued, ensuring that only the recurring portion of the invoice is accurately recognized over time. This strategic approach guarantees accurate revenue recognition for both recurring and one-time products, enhancing the overall financial integrity of your business.

Wrapping up

Embrace the powerful capabilities of Synder as it transforms your revenue recognition process into an automated and seamless experience. Bid farewell to manual updates and laborious calculations as Synder takes charge. With Synder as your trusted partner, all changes to subscriptions are meticulously managed, ensuring recognition schedules are consistently updated, providing you with real-time financial insights.

Synder’s revenue recognition feature stands as a game-changer for subscription-based businesses. Through seamless integration with both Stripe and QuickBooks, Synder simplifies and automates the entire revenue recognition process, delivering heightened accuracy, improved efficiency, and enhanced transparency. With Synder by your side, you can confidently make informed decisions and optimize your revenue recognition efficiency to its fullest potential.

Unlock the unrivaled potential of Synder and experience the streamlined revenue recognition process you’ve been longing for. Embrace effortless automation and bid farewell to the manual burdens of the past.