As a business owner, you know that sales are crucial to keeping your business running smoothly. But when customers don’t pay their invoices on time, it can have a significant impact on your finances. This doesn’t just directly affect your immediate cash flow, it is also a drain on your business’s time, resources, and energy, which can affect your ability to have healthy cash flow in the future! In short, sales are not the big answer they seem to be if your customers don’t pay on time.

By recognizing these direct and indirect connections between accounts receivable and cash flow, we can better understand and plan for:

- what happens when customers pay late, in part, or not at all;

- what businesses should do to ensure better accounts receivable results;

- what automated systems can contribute and where they fall short;

- what the human touch brings to your accounts receivable process.

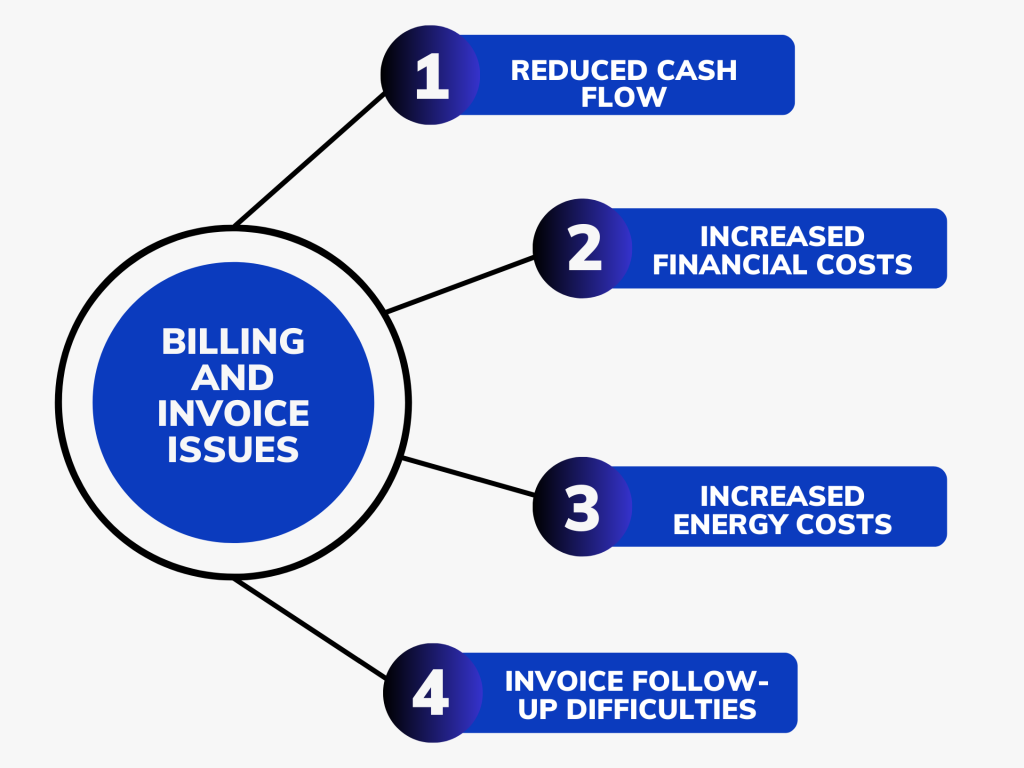

Billing and invoice management issues: What happens when customers pay late, in part, or not at all?

While no one wants to deal with overdue invoices, it’s an inevitable part of running a company, which can affect various aspects of your business operations. Let’s review them.

Reduced cash flow

Past due invoices mean the cash is not flowing as you might have anticipated, which means you may not have enough funds to pay bills or invest in opportunities for your business. This is bad enough, but the real problem comes with how these issues can cause a ripple effect. They pay late, so you pay late, consequently your shipments or deliverables are delayed, or maybe your ability to work with top-tier people isn’t as good. Stemming from there, you have more unhappy customers and more late payments. It does not take much for some ho-hum accounts receivable practices to snowball into some serious business health issues.

Increased financial costs

When invoices go unpaid, most often the time waiting for payment is not spent doing nothing. Instead, you spend additional time and money, labor, and energy on collections efforts. This might include hiring a collections agency or taking legal action. But, it is also as simple as needing your hourly staff to follow up 5 times with customers instead of three. Or having to take on expensive payment methods to encourage payment from clients. Additionally, if you have to borrow money to cover expenses while waiting for payments, you may incur interest charges or fees.

Increased energy costs

Late payments can strain relationships with your customers and your staff, especially if they feel they’re not being treated fairly. With staff, they may not have signed on to be the person who is dealing with Account Receivable (A/R). Or maybe what used to take an hour a week is now taking an hour or two each day. No one really enjoys following up on payments – even when they aren’t late!

Invoice follow-up difficulties

When it comes to customers, handling accounts receivable follow-up is a bit of an art. Frankly, it is like walking a tightrope when you are following up with your own customers. It can easily lead to a bit of a strained relationship or awkwardness. On the more extreme side, following up with late-paying customers in a way that isn’t well planned can absolutely result in lost business as well as lost funds and damage to your reputation in addition to the damaged cash flow you already have.

Invoice management strategies: What should businesses do to ensure better accounts receivable results?

We can all agree that the ideal situation is one where payments are never late in the first place. Luckily, by looking at why payments are late and what happens when they are, we can see some steps you can take to increase the chances that payments are made on time.

Establish clear payment terms when you send invoices

One way to avoid past-due invoices is to establish clear payment terms with your customers. This includes outlining due dates, payment methods, and consequences for late payments from before the sale is even final. Make sure your customers are aware of these terms before you do business with them. And make sure that these ways of doing business remain consistent and clearly present throughout your business communications.

Follow up early and often to increase on-time invoice payment

Don’t wait until an invoice is past due to follow up with your customers. Send reminders a few days before the due date and follow up promptly if a payment is missed. This can help clear up any misunderstandings and encourage timely payments.

Encourage communication between you and your customers

Try to head off typical reasons for a late payment or non-payment before they become problems by making it easy for customers to ask questions and gather information about their invoice and their account. Then make it just as easy for them to actually make a payment!

Consider incentives and penalties in your invoice system

Offering incentives for early payments, such as a small discount, can motivate customers to pay on time. Conversely, penalties for late payments, such as interest charges or late fees, can provide a disincentive for customers to delay payment.

Invoice management software: What an automated system can contribute and where it falls short

One of the biggest benefits of automated systems for accounts receivable is that they can take care of repetitive tasks and free up staff time. Some key benefits that are out there include:

- scheduling automatic reminders;

- scheduling recurring or timed payments in advance;

- cloud-based information where customers can see and update their account information;

- payment options that include the ability to pay online;

- monitoring and alerting to accounts that might be coming close to problematic;

- easy sharing of A/R information and activity across different parts of your business.

The tools we have at our disposal to develop and maintain an effective accounts receivable process are numerous and generally reliable. But they can’t do it all. And when everyone is using the same tools to do all of these things, it is likely that what we think is a good follow-up might just be the kind of follow-up that gets lost in the crowd.

First-class invoice management: What the human touch brings to your accounts receivable and invoice process

Automated systems can fall short when it comes to the human touch that is often needed to maintain positive customer relationships. Often it is the lack of discernment in all of our automation that often makes businesses hesitant to use automated solutions for the accounts receivable process.

Relationships between customers and clients are hard-won. When everything in accounts receivable is mostly done on automation, it can be easy to have concerns that those relationships might suffer. Many businesses that use all kinds of automation to survive and thrive better still reserve this last corner of their business for their most trusted employees – or even just themselves.

It is important to find a balance between automation and personal interaction to ensure the best results for your business.

The best of both worlds: Management software for invoice process

One service provider that has cracked this code is CollBox. CollBox as an automation integrates with your accounting so that they can easily monitor your accounts receivable’s health in real-time. Through this automated system, business owners and their accounting professionals get the benefit of all of this information.

But CollBox also recognizes that nothing replaces the ability of a human being to reach another person on a human level. Often people who pay late are not doing so by choice or because they don’t want to pay. They may be embarrassed, worried, or disappointed. An automated email reminder is not going to get to the bottom of things, let alone be able to work out a solution.

So CollBox is also a service. They use automation to empower their human staff to follow up consistently and professionally on your behalf. You are in charge of how you want your customers to be approached and what outcomes are acceptable – just like you are now. The difference is they do the work. This leaves you and your staff to concentrate on what you do best while they do what they do best – accounts receivable services.

Invoice management: Conclusion

Past-due invoices and accounts receivable in general will always have a significant impact on the cash flow of your business. Depending on the health of your accounts receivable processes, this is either a really good or a really bad thing. Fortunately, by establishing clear payment terms, following up early and often, considering incentives and penalties, and enlisting help where you are able, you can reduce the risk of late payments and maintain a healthy cash flow that fuels a healthy growth forward for your business.

Thanks for sharing and explaining about invoice management software. An invoice management system is a critical tool for restaurants that want to optimise their accounting and financial procedures.

Thank you for sharing your thoughts! Indeed, efficient management of past-due invoices is crucial for maintaining healthy cash flow, which is the lifeblood of any business, particularly in the dynamic environment of the restaurant industry. If there are any further insights or specific aspects of invoice management that you would like us to explore, please let us know. We are always looking to provide valuable content that meets the needs of our readers. Thanks again for your feedback!