If you’re a business dealing with currencies other than your native currency, say an American-based company also dealing with Australian dollars and Riyals, it’s important for you to record your foreign currency transactions accurately. A single miscalculation can lead to discrepancies and financial woes that can impact your bottom line. Who would want to risk that in today’s competitive market?

Think about dynamic exchange rates, various accounting standards, and the need for accurate reporting! All that sheds light on just how important recording your foreign currency transactions is. Here’s a guide that’ll help you get the hang of recording foreign currency transactions. Dive in!

Contents:

Understanding foreign currency transactions

Foreign currency transactions occur whenever you buy or sell goods and services priced in a currency other than your functional currency. This could include purchasing inventory from a supplier overseas or selling services to a client in another country. There are several types of foreign currency transactions you might encounter:

- Purchases: Buying goods or services priced in a foreign currency.

- Sales: Selling products or services where payment is received in a foreign currency.

- Receivables: Money owed to you in a foreign currency.

However, that’s not all you get to know about foreign currency transactions.

Accounting principles for foreign currency transactions

When dealing with foreign currency transactions, there are certain principles and ways you need to be mindful of:

GAAP guidelines for foreign currency accounting

Under Generally Accepted Accounting Principles (GAAP), specifically ASC 830, you must follow certain guidelines when accounting for foreign currency transactions:

- Functional currency: The initial steps for firms are to identify the functional currency—the primary currency you use in your business operations.

- Transaction measurement: Transactions denominated in foreign currencies are valued at the transaction date exchange rate and can be remeasured throughout each reporting period.

- Exchange rate differences: The gains or losses on fluctuations in exchange rates are recognized in earnings and thus impact the financial result.

- Translation of financial statements: The financial statements of the foreign operation should be translated into the reporting currency—the currency you use to present your financial statements, using current and average exchange rates for foreign operations.

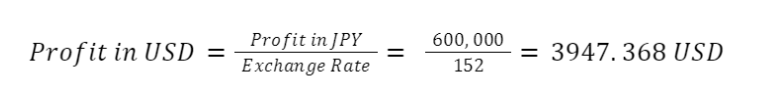

For example, A Japanese company that operates mainly in Japan and uses Japanese Yen (JPY) for most of its transactions, its functional currency would have JPY as its reporting currency. Let’s say, the company makes a profit of ¥600, 000 in a year. And if the company wants to show its profits or financial statements to investors and stakeholders outside Japan in US dollars (USD), then USD would be its reporting currency.

Now the company’s profit of ¥600,000 would be reported differently in the US, keeping the exchange rate of 1 USD = 152 JPY in mind. Here’s how:

Let’s speak about these guidelines in more detail.

How to determine exchange rates?

A major principle for dealing with multicurrency transactions is to determine which exchange rate to use. You’ve got to options to go for:

| Spot rate | Historical rate |

| The current exchange rate at the time of the transaction. | The exchange rate at the time of a previous transaction that affects the current one |

| Example: Let’s say a Canadian company wants to convert their profits from CAD (Canadian dollars) to USD (US dollars). If the company uses the current spot rate like 1 CAD = 0.72 USD and have to change the amount of 10,000 CAD, here’s how much it will receive: Amount in USD = Amount in CAD x Spot rate Amount in USD = 10, 000 x 0.72 = 7200 USD | Example: Now imagine the same Canadian company converted their profits some six months ago when the exchange rate was 1 CAD = 0.80 USD and have to change their profits this time using that same rate (historical rate), then here’s how much the company will receive: Amount in USD = Amount in CAD x Historical rate Amount in USD = 10, 000 x 0.80 = 8,000 USD |

How to record foreign currency transactions?

Now, when you get down to recording these transactions, you’ll go through two main procedures :

- Initial recognition: Recording the transaction at the spot rate on the transaction date.

- Subsequent measurement: Adjusting for any changes in exchange rates at each reporting period.

Steps to record foreign currency transactions

Here’s a step-by-step guide to recording your foreign currency transactions:

Step 1: Identify the transaction date and currency

Start by pinpointing when the transaction occurred and what currencies are involved. This will set the foundation for accurate recording.

Step 2. Determine the exchange rate

Next, find out the exchange rate on that specific date. This is crucial for ensuring that your records reflect the true value of the transaction.

Step 3. Record the transaction in the functional currency

Convert the amount from foreign currency into your functional currency using the exchange rate determined earlier. This ensures consistency across your financial records.

Step 4: Adjust for foreign exchange gains or losses

Finally, at each reporting period, adjust your records for any gains or losses due to fluctuations in exchange rates. This step is vital for maintaining accurate financial statements.

Practical example

Let’s say you purchase equipment from a supplier in Europe for €10,000 when the exchange rate is 1.2 USD/EUR. You’d record this as $12,000 in your functional currency.

In another case, if you provide services worth £5,000 to a client in the UK with an exchange rate of 1.3 USD/GBP, you’d recognize this as $6,500.

Risks and considerations in foreign currency accounting

Given the wide number of things at stake and the sensitive nature of these dealings, there are certain risks and considerations in the picture when it comes to foreign currency accounting:

Exchange rate risk

One major risk you face is fluctuations in exchange rates that can impact your financial results. A sudden change could turn a profitable transaction into a loss.

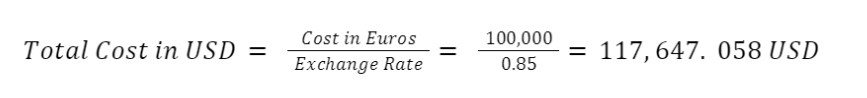

For instance, imagine you’re a US company who purchases machinery from a German supplier or manufacturer for 100,000 euros and at the time you ordered it, the exchange rate was 1 USD = 0.85 EUR.

Based on that exchange rate, here’s how you can calculate your initial cost:

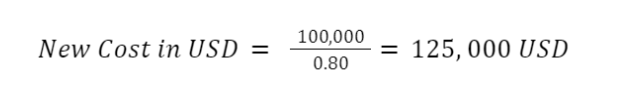

Now, enter an exchange rate risk and what you may have thought as a profitable deal can turn into significant extra expenditure. Let’s say you didn’t make payment right away and the time you decide to, the exchange rate changes to 1 USD = 0.80 EUR. Here’s how that can affect your new cost:

As a result of changes in exchange rate, you can face significant losses like:

Loss = 125,000 – 117,647.058 = 7352.942 USD

Impact on financial statements

These fluctuations can also affect how your financial statements appear to investors and stakeholders. For businesses with multicurrency transactions, these changes can lead to gains or losses that alter reported profits and asset values, potentially misrepresenting the company’s financial health. These risks are controlled through regular checking and updating the financial reports to reflect correct information and to maintain stakeholders’ confidence.

Best practices for mitigating risks

Here’s what you can do to mitigate these risks:

- Use hedging strategies: The most common way for companies to manage these risks is perhaps hedging. These include hedging instruments such as forward contracts, options, or swaps that may present an opportunity to lock in exchange rates for some future transactions. Hedging will protect your business from negative movements in the value of the currencies so that your bottom-line results are not affected by turbulence in the markets.

- Regularly review your exposure to foreign currencies: Ongoing assessment of your foreign currency exposure is at the core of any well-implemented risk management strategy. It requires analyzing current and future foreign currency transactions, defining what the fluctuations could mean for financial statements. You’ll be able to make better decisions on hedging or changing your currency management strategy by continuously monitoring your exposure and taking advantage of proactive steps toward market changes.

- Implement robust internal controls around foreign currency transactions: The backbone of good management lies in good internal controls. This would include having clear policies and procedures regarding the recording, monitoring, and reporting of currency transactions. Additionally, training your finance team about the implication of foreign currency fluctuations and frequent audits will help in highlighting issues before they turn out to be major ones.

- Automate your multicurrency transactions: Automation of your multicurrency transactions will give you a whole different perspective on how you approach the management of currency risks. With automated accounting tools like Synder, you’ll be able to synchronize sales data from different platforms in just a few clicks and reduce manual entry errors, recording every single transaction in real time at the correct exchange rate taken from your payment processor.

Such real-time tracking will help you stay right on top of your financial position. With Synder’s functionality at your fingertips, you’ll be able to automate your multicurrency accounting and make management of various currencies way less painful.

Want to give it a try? Sign up for Synder’s 15-day free trial or book a spot at the Weekly Public Demo to get a full walkthrough of all Synder’s features that can take your business to the next level.

Taking the above proactive steps will allow you to approach the challenge of multicurrency transactions with a better protection of the financial health of the business.

Wrapping up

Overall, accurately recording foreign currency transactions is vital for any business engaged in international trade. By following proper accounting practices and staying informed about exchange rates and regulations, you can avoid costly mistakes and ensure your financial statements reflect true performance.

If you’re looking to simplify your accounting processes and enhance accuracy, integrate a promising accounting solution, Synder, into your operations. With its seamless automation and real-time syncing capabilities, Synder can help you manage foreign currency transactions effortlessly and ace your international business game in no time! Time to get started!