Are you a rookie craftsperson seeking new opportunities within an online community? Or a veteran searching for more sales channels to grow your business? Either way, you’ve landed here because all of us share a common interest: Etsy.

How does Etsy work?

How do you get started?

What about Etsy payment processing fees? Listing fee? Taxes?

And so on, and so on.

We’ll save you hours of searching through Google, Reddit, and Etsy guides by answering the most pressing questions in the easiest and most understandable way.

So, what’s so special about Etsy? Let’s find out.

Key takeaways:

- Etsy is ideal for individuals who want to sell handmade goods, vintage, or craft supplies.

- Etsy offers sellers its own payment gateway, Etsy Payments. If it’s not available in your country, you won’t be able to sell on Etsy.

- Etsy withholds sales taxes on sellers’ behalf in states and countries where it’s required.

Contents:

2. What do you need to know before you start selling on Etsy?

3. Does Etsy require a business license?

6. What kind of taxpayer ID does Etsy require?

7. How does Etsy work with taxes?

Etsy in simple words

Imagine a medieval market at the heart of the city, bustling with carts and an array of products But with a whimsical Rapunzel vibe rather than a gritty Game of Thrones scene. That’s the essence of Etsy.

Despite its special charm, Etsy operates much like any other ecommerce platform. As a seller, you need to set up your business account, create product listings, attract your first potential customers, make sales, and then focus on growth.

But what makes the products so special?

Etsy has three main categories of unique products that sellers can list:

- Handmade goods;

- Vintage;

- Craft supplies.

The marketplace’s core principle, “Keep Commerce Human,” speaks to its focus on the audience interested in handmade products, supplies for such crafts, or unique vintage items that are at least 20 years old.

Everything seems pretty simple unless you try to understand the pitfalls and face something like Etsy seller fees or even taxes. So, instead of a step-by-step guide to setting up an Etsy account, let’s dive into the most popular questions a seller might have when starting on Etsy.

What do you need to know before you start selling on Etsy?

Even though we won’t go into details of how to set up an Etsy store, it’s still important to note that this is the most essential step. Without an Etsy business account, your products won’t reach the global audience you’re aiming for.

Another key point is ensuring that your country is eligible for Etsy Payments, the marketplace’s primary payment method. Even if you can create an Etsy business account, if your country isn’t on the list, you won’t be able to accept payments. We’ll delve into this later, but here’s a handy table of eligible countries so you can check this right from the start.

Etsy Payments is currently available in:

| Australia | Estonia | Israel | Netherlands | Slovenia |

| Austria | Finland | Italy | New Zealand | South Africa |

| Belgium | France | Latvia | Norway | Spain |

| Bulgaria | Germany | Lithuania | Philippines | Sweden |

| Canada | Greece | Luxembourg | Poland | Switzerland |

| Croatia | Hong Kong | Malaysia | Portugal | Türkiye |

| Cyprus | Hungary | Malta | Romania | United Kingdom |

| Czech Republic | Indonesia | Mexico | Singapore | United States |

| Denmark | Ireland | Morocco | Slovakia | Vietnam |

Etsy Payments via Payoneer is also available to sellers in Argentina, Chile, China, India, Japan, Peru, Thailand and Ukraine.

Does Etsy require a business license?

No. Etsy doesn’t require sellers to have a business license to sell on the marketplace, but your city, state, or country might. It’s important to check with your local laws and regulations to ensure you comply with all legal requirements for operating your business. For example, in California, you must register and obtain a seller’s permit to sell on Etsy before making your first sale. Always verify with local authorities to stay on the safe side.

How to get paid on Etsy?

Back to the burning topic: Etsy Payments is the internal system that allows you to accept a variety of payment methods, including:

- Credit cards;

- Etsy Gift Cards and Etsy Credits;

- PayPal;

- Debit/ban cards;

- Apple Pay;

- Google Pay.

To receive payments on Etsy, you’ll need to connect your bank account to your Etsy business shop. However, the way you’ll need to add the bank details depends on your country. For example, U.S. sellers use a third-party service called Plaid, which verifies your bank details to ensure smooth deposits.

Once you’ve set up Etsy Payments in your shop settings, payments from active buyers will be deposited into your bank account according to your shop’s payment schedule, which can be daily, weekly, or biweekly.

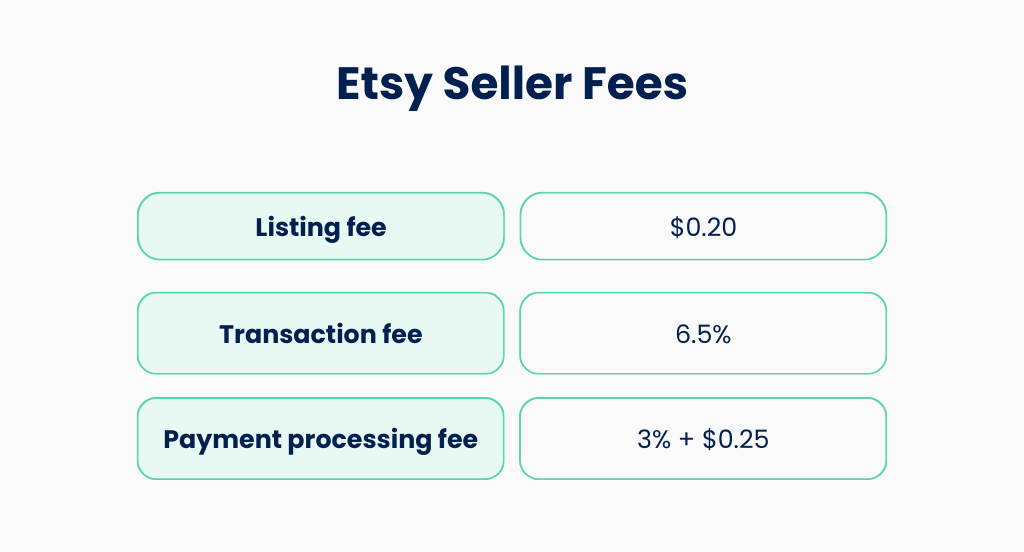

What are Etsy’s fees?

Etsy charges three main types of fees:

Note: Etsy transaction fee, listing fee, and payment processing fee are in USD and may vary depending on your bank account and your home currency.

Apart from those, once you’ve opened your Etsy shop, you’ll be charged a one-time setup fee of $15. For sellers from Argentina, Chile, China, Japan, Peru, Thailand, or Ukraine who onboard using Payoneer, this fee will be in USD and is non-refundable. Additionally, taxes may apply.

What kind of taxpayer ID does Etsy require?

To comply with local tax laws, Etsy requires sellers to provide taxpayer information. The type of taxpayer ID you need to provide depends on your location:

For U.S. Etsy sellers

- Social Security Number (SSN): For individual sellers.

- Employer Identification Number (EIN): For business entities.

Note: Even if you’re a sole proprietor running an Etsy shop, you can still choose to get an EIN. This offers several advantages: you can hire employees, incorporate your business, form a limited liability company or partnership, and set up a solo 401(k) retirement plan.

For non-U.S. Etsy sellers

- Foreign Tax Identification Number (TIN): Specific to your country.

- Other identifiers: May include VAT or GST numbers, depending on local tax requirements.

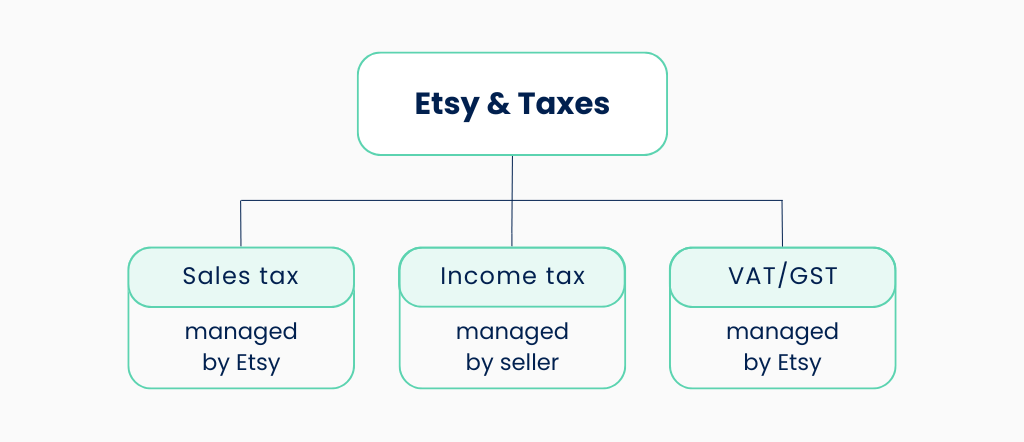

How does Etsy work with taxes?

When selling on Etsy, it’s important to know about the following taxes:

#1. Sales tax

Etsy automatically calculates, collects, and remits sales tax on behalf of sellers in states and countries where it’s legally required. This ensures compliance with local tax laws without additional effort from sellers. While Etsy handles the tax side of things, it’s also essential for sellers to provide clear information about how long does Etsy take to ship their products, as shipping times can vary based on location and the type of item sold.

Note: If the buyer paid directly to a PayPal account instead of Etsy Payments and the order meets the criteria for Etsy to remit sales tax on the seller’s behalf, Etsy will supply the seller with the sales tax as part of the payment. Then, Etsy will net the sales tax from a Payment account.

#2. Income tax

Income tax is your (seller’s) responsibility. You’ll need to pay income tax based on your personal tax situation and your business profits. This is done annually based on your net income. Keep track of all your physical expenses, while Etsy has sales reports for all your sales and fees.

Since Etsy processes credit card payments for sellers through Etsy Payments, the platform is required to provide a 1099-K form if you’re U.S.-based and meet certain thresholds (for 2024, it’s receiving at least $5,000 in Etsy Payments). This form summarizes your total sales and is used for income tax reporting.

#3. VAT and GST

In certain countries, Etsy collects and remits Value Added Tax (VAT) or Goods and Services Tax (GST) on digital services fees. Sellers are responsible for managing their VAT/GST obligations on the sale of goods, where applicable.

💡 Tip: Automating your bookkeeping and accounting processes, like recording Etsy sales in systems such as QuickBooks Online/Desktop, Xero, or Sage Intacct, can save you time and ensure accuracy come tax season. An accounting automation solution like Synder Sync can seamlessly record data from Etsy and Etsy Payments, including fees and taxes withheld by Etsy, into the correct accounts. What does it mean? No hassle and missing data at the end of the season!

Etsy as a marketplace: Conclusion

So now you know what to expect from the first steps on the Etsy marketplace, which fees and taxes to be aware of, and what kind of taxpayer ID Etsy requires from its sellers.

And that’s just a sneak peek of how Etsy works! We hope we’ve covered most of your burning questions and provided the answers you need. While we can’t say definitively whether selling on Etsy is worth it—since it varies for everyone—we can arm you with valuable information to help you dive into this new venture fully prepared.

But if you never try, you’ll never know, right?

Share your thoughts

Have you had any experience selling on Etsy? Do you have any tips or questions about getting started? Share your thoughts and join the conversation in the comments below.